How Might a Trader Use the Announcement Effect?

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

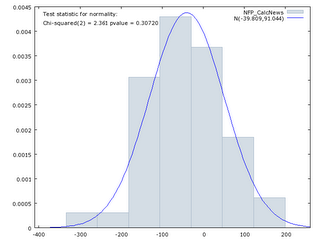

Traders often develop triggers for major economic announcements. They place bets on the upside and downside. Here is how a trader, armed with information on how the Euro moves in response to the non-farm payrolls announcement, might see the opportunity. First here is how news has been distributed in the past (news is measured as actual minus the expectation derived from the econoomic derivative prices from an auction just before the announcement: Now, based on how the Euro has reacted to the news, here is the buy/sell picture:

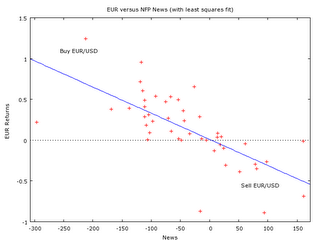

Now, based on how the Euro has reacted to the news, here is the buy/sell picture:

So, on negative news, buy the EURUSD pair, on positive news sell the EURUSD. Often traders will take both positions.

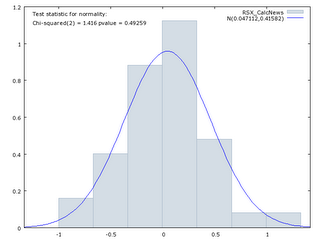

Here is the news distribution for the retail sales excluding automobiles (RSX) announcement:

So, on negative news, buy the EURUSD pair, on positive news sell the EURUSD. Often traders will take both positions.

Here is the news distribution for the retail sales excluding automobiles (RSX) announcement:

And here is the buy/sell chart:

And here is the buy/sell chart:

Looking at the buy/sell charts one can see how often in the past the announcements have caused big moves in the exchange rate. Returns are calcualted as continuously compounded returns (the ratio of the natural logs of the exchange rate over the rate a minute ago times 100). So you can see that a surprise of +/- 150 on the NFP will give a 0.5% return on the EUR . Similarly , news of +/- 0.5 on the RSX will generate a a bit less than 0.1% return.

You might also see that good and bad news are not always symmetric. More on this to come ...

*Sting, in his song An Englishman in New York, wrote "If manners make the man as someone said". Well it was William of Wykeham (1324-1404) who said it. The "Manners Makyth Man" crest above is from New College Oxford, the college he founded.

Looking at the buy/sell charts one can see how often in the past the announcements have caused big moves in the exchange rate. Returns are calcualted as continuously compounded returns (the ratio of the natural logs of the exchange rate over the rate a minute ago times 100). So you can see that a surprise of +/- 150 on the NFP will give a 0.5% return on the EUR . Similarly , news of +/- 0.5 on the RSX will generate a a bit less than 0.1% return.

You might also see that good and bad news are not always symmetric. More on this to come ...

*Sting, in his song An Englishman in New York, wrote "If manners make the man as someone said". Well it was William of Wykeham (1324-1404) who said it. The "Manners Makyth Man" crest above is from New College Oxford, the college he founded.Labels: Trading

0 Comments:

Post a Comment

<< Home