Standardized News

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

Comparing Different News ConsistentlyTiming of the announcements matter, some are more important than others.

Andersen et. al.* show that some announcements “… are to some extent redundant, and the market then only reacts to those released earlier.’ (p. 13).

Andersen et. al. note that “although closely timed news events are highly correlated, the correlation does not create a serious multicollinearity problem except in a few specific instances. For example, industrial production and capacity utilization are released at the same time, and they are highly correlated (0.64). In general, however, the event that two announcements within the same category (e.g., real activity) are released simultaneously is rare.” (p. 11)

I investigate which announcements matter and confirm that some announcements matter a lot; some seem to have a marginal impact, while others do not matter.

To do this it is helpful to follow Andersen et. al. and define standardized news (S) as the surprise divided the sample (for each announcement) standard deviation of the news (σ):

Nt = At - Et-δ(At)

St = Nt / σ

Standardized news allows for comparisons of responses of different asset prices to different news.

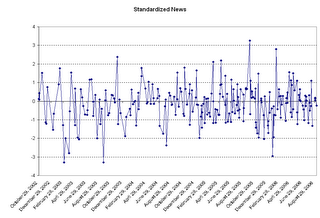

There is a lot of news. Even if we restrict our attention to those announcements for which there are economic derivative prices there were 231 announcements in the last four years (note that this is not a traditional line chart as there are sometimes two announcements on the same day):

Here is what standardized news looks like (for 7 announcements all together) if you do a frequency plot of the data against a normal distribution:

- An aside - This is a plug for a nice little FREE econometrics package that produced the above chart. The package is called Gretl (Gnu Regression, Econometrics and Time-series Library).

With news standardized we can compare how a big non-farm payrolls (NFP) surprise compares to a big retail sales news announcement. And, with them both on the same footing, we can say which one is more important.

Of course importance depends on your perspective. If NFP news moves the U.S. 30-Year Treasury bond futures contract but not the foreign exchange market and you are an FX trader then why should you care?

So to be relevant I need to address which news is important (relative to other news), but also which news is important for which markets.

Here is the reference:

*Andersen, Torben G., Bollerslev, Tim, Diebold, Francis X., Vega, Clara, (2002) “Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange” NBER Working Paper Series, NBER Working Paper No. 8959, May 2002. pdf link.

Labels: news

1 Comments:

This comment has been removed by a blog administrator.

Post a Comment

<< Home