Recent Developments in How Economic Announcements Affect Financial Markets

It is not news that news moves financial markets. What is news is that economic derivatives, auctions of puts and calls on economic releases, allow us to get a much better read on market sentiment than was available previously from surveys. Also real-time financial markets data has allowed the effect of the announcement to be separated from other influences.

It is not news that news moves financial markets. What is news is that economic derivatives, auctions of puts and calls on economic releases, allow us to get a much better read on market sentiment than was available previously from surveys. Also real-time financial markets data has allowed the effect of the announcement to be separated from other influences. Using derivatives based measures of market expectations and real-time financial data, we quantify what moves, how much, and when so that your insights can be turned into profit.

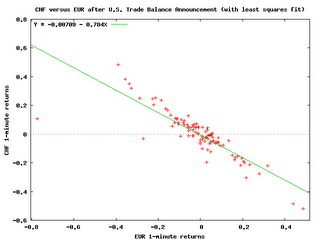

As an example, the charts show how the EUR and the CHF move in opposite directions when the

We are researching an expanding group of markets (Gold; AUD; CAD; CHF; EUR; GBP; Heating Oil; JPY; Natural Gas; S&P 500; 2, 5, 10, and 30-Year T-Bonds) and economic announcements (U.S. Retail Sales; Initial Jobless Claims; Non-Farm Payrolls; International Trade Balance; Gross Domestic Product; CPI; ISM Manufacturing PMI Index; Eurozone HICP Inflation Index).

Our focus is, however, driven by client needs, contact me for details.

Labels: Summary

0 Comments:

Post a Comment

<< Home