The News Impact Curve (Modified)

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

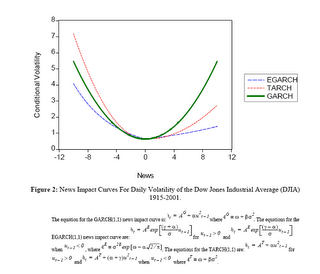

News drives the market. Good news lifts the market. Bad news dampens growth. The effect, however, is not symmetric: good news does not lift the market as much as bad news depresses it; good (bad) news does not lift (depress) a bull market as much as a bear market. Positive and negative stock return innovations have different impact on the volatility, as found in the literature by many researchers, for example Campbell and Hentschel (1992) and Engle and Ng (1993). Volatility following bad news is found to be higher than following good news. This is the well documented predictive asymmetry effect in stock market, which is sometimes called the leverage effect. Besides that good and bad news influences volatility differently, good news in a bull market may not lift up the market as much as in a bear market or vice versa. Intuitively, given a continuous downward market movement, bad news may drag down the market more than if there has been upward market movement. In other words, in a bear market, the market is waiting for bad news and bad news shakes market confidence more than if it has been a bull market. Although some volatility models, mainly in the regime switching context, have allowed for a bull and bear market effect, for example the switching regime GARCH models by Hamilton and Susmel (1994) and Cai (1994), the literature so far has not considered the asymmetric impact of good and bad news in bull and bear markets, which I found to be significant in a paper entitled "How Bad is Bad News; How Good is Good News?". Rob Engle got a Nobel prize for his work on volatility models. Volatility tends to be clustered together, that is there are periods of volatility storms and calms, in which, large squared returns tend to be followed by large squared returns. Engle and Ng (1993) have suggested, for these conditional volatility models, a standard measure of how news influences stock volatility, a news impact curve. Given information up to current time, the news impact curve examines the relationship between the news and future volatility. The news impact curve plots news scenarios, that is a range of bad and good news, on the horizontal axis, against the resulting volatility. Here are some News Impact Curves for the Dow Jones (estimated daily from 1915-2001), showing how volatility responds to good (right side of the chart) and bad news (left side of the chart):

Figure 2 (which, in Firefox at least, can be expanded by clicking on it and then you can zoom in for a closer view) shows the general characteristics of news impact curves, that GARCH model is symmetric around zero, whereas TARCH and EGARCH are asymmetric, with different slopes.

An alternative to the differing slopes of the EGARCH and TARCH models is the asymmetric GARCH (AGARCH) model by Engle (1990) (The AGARCH model is called Quadratic GARCH in Campbell and Hentschel (1992)).

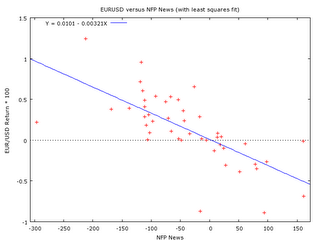

While the news impact curve for volatility was defined some time ago, I think the same curve for the first moment is more interesting than that for the second moment. Don't you?

I'll be concentrating on the movement in the first moment, that is returns in financial markets. And in coming posts I'll show how some very simple, naive, rules can be used in combination with the (modified) news impact curve.

While the news impact curve for volatility was defined some time ago, I think the same curve for the first moment is more interesting than that for the second moment. Don't you?

I'll be concentrating on the movement in the first moment, that is returns in financial markets. And in coming posts I'll show how some very simple, naive, rules can be used in combination with the (modified) news impact curve.

References

Cai, J. (1994). A Markov Model of Switching-Regime ARCH. Journal of Business &

Engle, R.F. (1990). Discussion: stock market volatility and the crash of 87. Review of Financial

Engle, R.F. and V.K. Ng (1993). Measuring and testing the impact of news on volatility. Journal

Hamilton, J.D. and Susmel, R. (1994). Autoregressive Conditional Heteroskedasticity and

Labels: news

2 Comments:

Hi. This is a really great analysis. Could you please tell me how in matlab a news impact curve can be constructed. I did implemented the aforementioned EGARCH and TGARCH models but i am unable to obtain similar U-Shaped curve (mine is more like a demand curve). If possible, please send me your codes. I hope to hear from you soon.

Thanks

SALMAN KHAN

Student(Finance)

France

Intresting I have come up with the same conclusion you have. To be ahead ofthe game use News. I have successfully converted through news and using spread betting £120 - £587 in four weeks. Please read article, I think you would find it intresting. But what I am struggling with is which bits of news to act on as there are many layers and depths. Please e-mail me would like to chat to you about this!

Post a Comment

<< Home