Caveat Emptor - Tomorrow's Dec. 2006 Non-Farm Payrolls Announcement

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

*** Updated 4:00pm EST at the close of the CME Economic Derivative auction ***

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

*** Updated 4:00pm EST at the close of the CME Economic Derivative auction ***

There seems to be lots of uncertainty leading up to tomorrow’s non-farm payroll announcement.

Below are the results from the economic derivative auctions that give the best market expectation for tomorrow. I have included in the table the time and date of the auction that gives the market expectation and the historical average from previous auctions:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notice that the mean forecast has moved from 113 to 85 since yesterday.

But look at the volatility. Yesterday it was 290, today it is 318 (3.6 times the average historical volatility of 87).

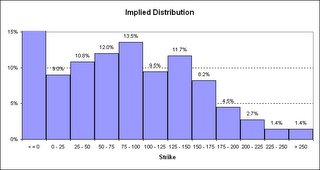

Here is the implied distribution from yesterday:

And here is the implied distribution from this morning:

And here is the implied distribution from this afternoon:

Look at the latest distribution. The calculated average (from the put and call prices) published on the CME website is 85.8 thousand jobs but the mode is for no growth in jobs (a derivative strike price of 0 jobs).

A dispersion in expectations means that there is more uncertainty than usual in the market. This could be good or bad depending on your perspective.

There is one more auction (7-8am) in advance of the release at 8:30am tomorrow. If you are interested, the link to the auction results is here.

Labels: NFP

1 Comments:

Interesting to know.

Post a Comment

<< Home