It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

The best news depends on two factors:

- The best measurement of the actual market move; and,

- The best measurement of the market's expectation.

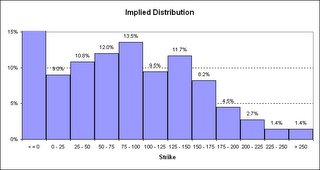

A market expectation based on information from derivative auctions outperforms survey measures.

Apart from proving more information the Economic Derivatives or market-based forecasts are found by Gürkaynak and Wolfers to outperform the survey data. They:

“… establish that the Economic Derivatives forecast dominates the survey forecast (although survey forecasts perform quite well) both in predicting outcomes and in predicting market responses to economic news.” (p. 13)

And,

· “… that central tendencies of market-based forecasts are very similar to, but more accurate than surveys. Further, financial market responses to data releases are also better captured by surprises measured with respect to market-based expectations than survey-based expectations, again suggesting that they better capture investor expectations. Some behavioral anomalies evident in survey-based expectations – such as forecastable forecast errors – are notably absent from market-based forecasts.” (p. 1)

The Federal Reserve Board of San Francisco (2006) (Wolfers) took data from the first 153 of these Economic Derivatives auctions and compared them with an alternative forecast aggregator: the survey of the expectations of financial market analysts taken on the Friday prior to the data release. They asked “which better predicts the actual data?” The Economic Derivatives forecasts were slightly (5%–10%) more accurate, although these differences were not statistically significant. They also found, more interestingly, once one knows the Economic Derivatives forecast, there is no useful information in the survey-based forecast.

They also analyze the change in stock and bond prices from 5 minutes before the announcement to 25 minutes later for the two alternative measures of news. In each case, they confirm that the Economic Derivatives market better predicts financial market responses to economic data than does the alternative survey-based measure.

Derivatives data was available for 7 series (now the CME only maintains 4) with the longest history going back monthly to September 2002. Survey data is available for some 170 series with the longest history going back weekly to 1980.

While the Economic Derivatives data is superior in terms of information content and usefulness for measuring the announcement effect, the survey data has a longer history and broader coverage.

I use the economic derivatives data.

Labels: Market Expectations

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.

It is not news that news moves financial markets. This blog will publish research on how, when, why, and which news moves what financial markets.