It is not news that news moves financial markets.

This blog will publish research on how, when, why, and which news moves what financial markets.

The non-farm payrolls announcement is due this Friday, November 3rd, at 8:30am. What are some possible scenarios for the market’s reaction?

The Forex Resource Guide lists economic calendars that often provide forecasts of upcoming announcements or market expectations surveys.

This gives us a range of forecasts and market expectations:

| Today FX: 125

Briefing.com Forecast 135

Briefing.com Consensus: 125

Bloomberg Consensus: 120

Forex Calendar: 130

MarketWatch: 130

TheStreet (Reuters): 125

Average of Forecasts: 127

|

So we have a range on 120-135 (thousand jobs) with 125k being the favourite prediction but a bit of skew to the upside gives an average forecast of 127k.

What is wrong with these forecasts?

1. They are sparse. Forecasts that drive financial markets are the expectations that are held by the millions of investors worldwide. The outcome of these expectations can be observed in asset prices and valuations. On the other hand, forecasts are the opinions of a few professionals and surveys usually canvass only a couple of dozen opinion leaders who may represent the mainstream.

2. They are clustered. Forecasters talk to each other and this influences their perspective. While it may pay, in terms of more press coverage, to be slightly controversial, it does not always pay to be an outlier. Most forecasters want their prediction to lie in the middle of other forecasts, most of the time.

3. They don’t answer the question that really interests you. Surveys cover key economic forecasts but do not tell you about the things you really care about, your particular portfolio of financial assets or risk factors affecting your holdings.

What is a better source of information?

People are putting down real money and betting or hedging the outcome of tomorrow’s non-farm payrolls release. From the derivatives auction for non-farm payrolls I can construct a full distribution of possible outcomes rather than the rather sparse, aggregated forecasts available from market surveys.

Here is what a market comprised of hedge funds and large banks thinks about tomorrow’s release (this is at the time of writing, there will be more bidding and the numbers will change up until 15 minutes before the release):

This chart is also currently available from the CME.

This gives a much richer picture as we can see a much wider dispersion. There is information in this disagreement. Now we can derive scenarios for what will happen in financial markets if the news is different from the mean expectation of 102k.

The 12-month moving average is around 160k, way above the forecasts and surveys. But from the derivatives information we can see that there are a fair number of people betting on a number this high. In fact 37% of the market is expecting a number above the most popular forecast of 125k. If we went with the traditional survey numbers we not be aware of this market sentiment.

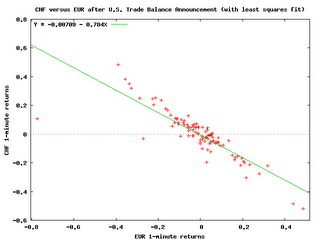

Using the historical relationship between surprises in the non-farm payrolls (difference between the actual and the derivative, auction-based market expectation) we can derive a range of scenarios, possible outcomes, for the release on various financial markets.

Surveys of forecasts can be used to develop scenarios for risk management to allow risk managers to understand their potential losses, conditional on a range of forecasts. The average forecast and the range of forecasts can be used to build a model of the distribution of market participants' expectations. The model can then be used to address the problems of sparse and clustered data. For more on how forecasts can be useful there is a paper I wrote a while ago at: "Using forecasts for risk management".

The recent developments in economic derivatives means you no longer have to fit distributions to sparse forecasts. Now you just need to translate the distribution of economic indicator movements into something that is relevant to you.

And this is what this blog is all about.

Labels: NFP

).

).